In this category:

Overview

TalkPoint was created for users to leverage a prospect's potential pain points and provide factual information of the reason you think there is a beneficial opportunity.

We do this by analyzing available data points like LCM filings, Premium to employee count, and incumbent carrier performance with a pool of their peers (ranging in size of 75 to 5k) based on location, employment count and primary industry classification, and is noted at the bottom.

You can omit sections by clicking on the orange printer icon to the right of its section-

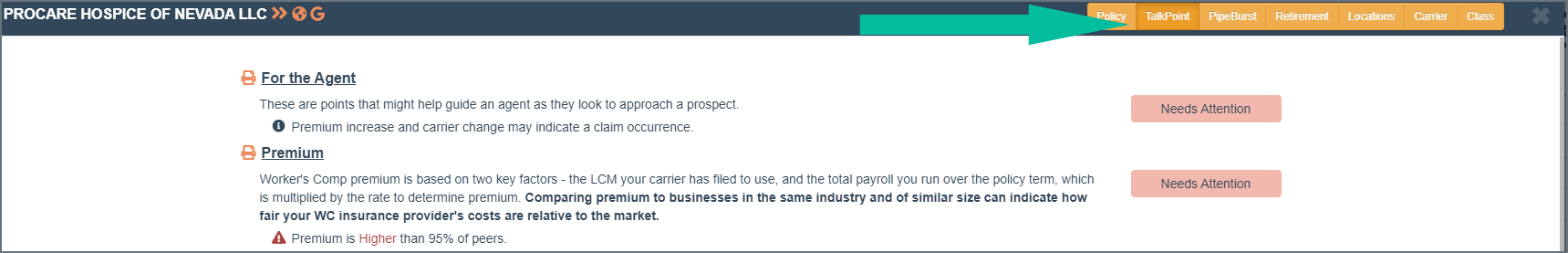

For the Agent

This section will call out potential subsurface details based on coverage transaction patterns. For example, a premium increase in addition to an underwriting carrier change with no major change to employee count (based on retirement) may indicate claims. Just as a 25% decrease on renewal might indicate competition (and the incumbent matched).

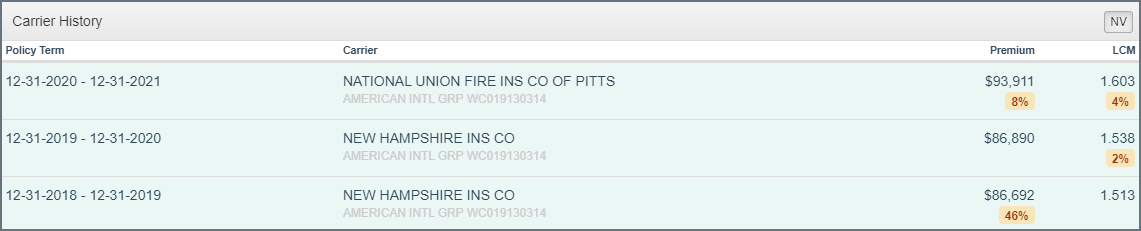

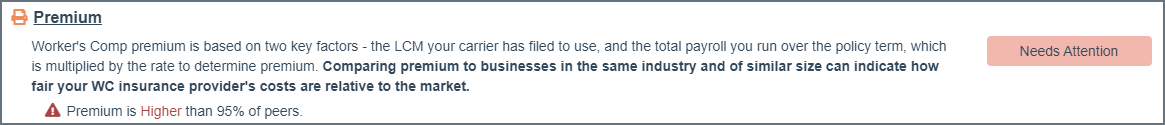

Premium

Comparing premium among peers of similar employee count and the same primary classification we can benchmark where the prospect ranks.

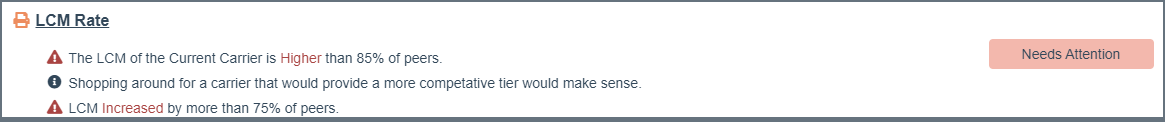

LCM

This benchmarks the incumbent's LCM filing compared to all other carriers insuring similar businesses.

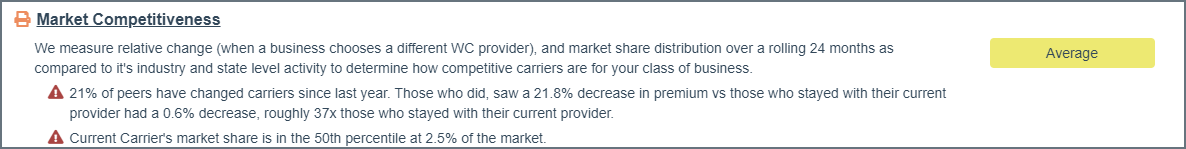

Market Competitiveness

This splits peers into two groups - those who changed carrier groups and those who renewed - comparing the outcome in terms of net change in premium and/or LCM. In this example we're looking at a plumber. Plumbers who switched saved 22% on average, vs .6% for those that renewed.

OSHA

Like most of the above, this section will appear if the prospect has had OSHA violations in the past.

Peer Comparison

At the bottom you'll see the sample size the prospect was compared with. You can also edit the name by clicking on it.